不過今次政府撤銷銷售稅,就好似特首曾蔭權,成功拆除喺司長唐英年身上,可以同曾蔭權政權同歸於盡嘅自殺式爆炸裝置。唔知道幾時會到 「A貨學券制」呢?

(REMEMBER TO LINK ME! AND SHOW YOUR FRIENDS) LEAVE COMMENTS!回貼! LEAVE COMMENTS!回貼! LEAVE COMMENTS!回貼! plz.

噚日,孫柏文約 咗《利字當頭》一欄總舵主利世民兄食飯。因為我有一個經常遲到嘅壞習慣,所要去到餐廳嘅時候,已經見到世民兄坐低睇緊餐牌。當我走埋去,坐低嘅時候,世民 兄就同我講:「你又遲到,我好肚餓。不如,叫咗嘢食先至慢慢傾。」所以,我就攞張餐牌睇,睇吓有乜好食。睇吓睇吓,我忽然問咗利世民兄一句:「你呢排有冇 叫雞?」

食物愈唔安全,對大財團愈有利

唔知道佢係唔係血糖低,不過一聽到我嘅說話,佢就使出我好耐未見過嘅「超級薩亞人」眼神,問番我一句:「孫柏文, 你喺到講乜啊?」我都呆一呆,亦即刻解釋,因為唔知道有乜好食,又俾呢排啲有關食物安全嘅新聞纏繞,所以先至想了解世民兄嘅飲食習慣有冇改變。又可能因為 我曾經做過當時係立法會議員陸恭蕙嘅intern,沾染咗陸議員嗰種將番鬼佬環保詞語low energy變成「低能」嘅中文用法(disclosure:陸議員同我同一間中學畢業,大家中文都係咁上下),所以先至衝口而出,問佢有冇「叫雞」。解 釋完之後,世民兄就大笑,亦放低餐牌向侍應生叫咗個咖喱雞飯。

我哋一路食飯,就一路討論如果大眾市民覺得食物唔安全,用經濟角度分析,會有乜嘢後果出現。 咁我哋都同意,食物愈唔安全,對大財團愈有利,而理由亦好簡單。最初,食物供應鏈當中,不論係種植、飼養商,分銷商或者零售商戶,全部都可能係小商戶。

有 一日,某項食品嘅安全出咗問題,市民第一個反應就係罷買該項食品。而政客第一個反應就係「再三要求」政府「確保」食物安全。當然,政府根本就無能為力,所 以市民亦會漸漸覺得政府冇可能確保食物安全,繼續罷買。不過,因為有些食物,例如雞蛋,係日常飲食當中佔有太重要嘅地位,市民冇可能長期罷買,所以必定會 有人察覺到,市民其實肯出高價去買雞蛋,只要供應商可以確保安全就可以。

如果你係小商戶,Sorry

不 過,一個零售商戶如果要確保食物供應係安全,就一定要有規模。因為零售商戶淨係要養活一隊人去做檢查,都要好多錢,所以零售商戶做唔到某個銷量,根本不能 彌補檢查成本。大家都知道街市擺檔嘅個體戶,根本冇可能檢驗食物,漸漸就會傾向幫襯連鎖式超級市場。當然,大家都知道超級市場都經常有有關食物出問題嘅醜 聞,不過大家都知道我哋特區超級市場嘅反應,一定比政府快。因為如果出事,負責安全嘅超市職員面對嘅高層壓力,一定會比政府負責安全嘅公務員多。

正當世界 各地嘅連鎖式超級市場,都在尋找盡量安全嘅食物供應時,都希望購買過程可以愈簡單愈好。最好就係可以同一間飼養商協商,毋須再去另一間。所以大家亦會見到 飼養商規模愈來愈大。到時,食物安全絕對會提升,而因為消費者願意出比現在更高嘅價錢,去買一份安心,呢啲大型飼養商、零售商亦會賺大錢。其實我所講嘅已 經發生緊,前日喺花旗國都有一單買賣,就係兩間家禽飼養商進行收購合併(Pilgrim's Pride同Gold Kist),成為全球最大嘅飼養商。

如果你係一個食物供應鏈當中嘅小商戶,唔好話我冇警告過你。

當時我話,只要市場相信「高銅價」唔係泡沫,而係因有本身供求、價高嘅理由,江銅就可以升一倍。

理由係,睇江銅由7至10月嘅第三季可以賺0.518人民幣一股,即係話,每年每股盈利2元一股。

當然,第三季銅價亦於3.2至3.7美元一磅之間徘徊(噚日落筆一刻,銅價每磅3.14美元),所以江銅想每年每股有2元盈利,銅價一定要重上呢個水平。

200日線點都要試試

每 股有2元盈利,而市場又覺得江銅應該有八倍市盈率時,股價就可升到16元。噚日收市,江銅股價就係8.36元。大家可能會問:「上一次第三季,銅價徘徊喺 高位,市場知江銅會賺大錢。不過,因為市場都相信銅價係泡沫,所以江銅股價都冇受惠,今次銅價就算重返高位,江銅股價點解會升呢?」

佔盡天時地利人和

今 次江銅股價會升嘅理由係,銅價再挑戰200日線,只要唔跌穿,市場就會確定銅價升軌繼續,江銅股價就會有爆炸性升幅。

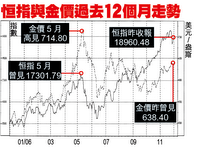

好多時,一隻股票好、原材料又好,上 升速度有如銅價自05年5月至06年5月咁急、咁多,都需要下試200日平均線,才知道是否升勢繼續。大家可能會問:「咁樣嘅情況,有冇前科可鑑」有,我 今日畫咗個圖表,提供個例子畀大家睇睇。

大家只要睇吓05年中至06年初,油價同857中石油股價嘅走勢關係圖,就會明白我嘅意思。

最後,銅價要重拾升 軌,其實已經佔盡天時、地利、人和。首先,有花旗國中央銀行濫發鈔票,仲有,祖國需求有增無減等等嘅基本理由,銅價應該可以保持升勢。銅價幾時可以肯定重 返200日平均線之上?我唔知道,不過發生嘅一刻,孫柏文當然會提醒大家。

Follow the story from 1 to 6.

大家作為《金手指》嘅fan屎,都會留意到,孫柏文每一次出「一注獨贏」呢四個字為大家提供投資建議嘅時候,都會提供埋「目標價」同目標價嘅「時限」。

例如,今年3月6日叫大家「一注獨贏買白銀」嘅時候,我為大家提供嘅目標價就係120美元一盎斯,而有效限期就係10年至2016年3月6日。

不 過,我相信大家都留意到,我喺11月22日叫大家「一注獨贏買和黃」嘅時候,冇提供埋目標價同目標價嘅時限。理由係和黃嘅3雖然推出完全拋棄以前經營模式 嘅X-Series「無限無線寬頻服務」,不過因為和黃當時未公布X-Series嘅定價,所以我決定等和黃出定價先至為大家提供目標價。

咁上個禮拜五,和黃喺英國嘅3 UK卒之成為第一個推出X-Series嘅市場,亦同時間宣布定價,所以今日我就為大家提供我嘅目標價同目標價嘅時限。

目標價:100元一股

年期:一年至2007年11月22日

大 家可能會問:「點解100元?」首先,我知道好多人覺得買和黃,就等如買佢哋可以運用財技「解決」3多年虧損嘅問題。有啲同行財經口水佬,更加覺得因為可 以睇得明和黃盤數,而引以為榮。不過,經過一個周末嘅時間,我相信市場會將和黃由一間要倚靠財技嘅「計數股」,變成一間炒「無線寬頻服務破格先驅」嘅「概 念股」。

原因係和黃X-Series喺英國嘅定 價,比一般無線服務評論員估計為低,仲要低好多。定價吸引程度,令一些以前多次狠批過和黃嘅英國鬼佬評論員,都大讚和黃今次爭一口氣,仲話會完全改變全行 嘅收費服務模式,令「畀咗錢就可以任用」遲早都會成為行規。市場覺得呢個可能性有幾高?就連Vodafone嘅總裁都喺上個禮拜五咁講,所以今次和黃真係 正途上嘅先驅。

撥亂反正好事近

大 家可能會問:「我都知勁,不過消費者有冇興趣先?」聽聞3 UK嘅網站喺上個禮拜五,因為有太多人瀏覽,所以出現「死機」情況。仲有,平時出咗名快聽電話嘅3 UK客戶服務,都因為有太多人打電話去買X-Series服務,導致客戶需要面對超過45分鐘嘅等候時間,先至可以同服務主任講電話。所以我絕對有信心消 費者喺呢個定價水平,對X-Series有興趣。

噚日,我同一個做對沖基金嘅朋友喺灣仔修頓打籃球,講起消費者對X-Series嘅反應同影響,佢就話: 「嘩!有少少似playstation 3,最好就係3 UK每個禮拜一路公布上客數量。如果市場開始相信3會冇事,和黃真係可以當『概念股』咁炒,年底見100!」可能我朋友忘記已經係12月,仲剩番十幾日, 都係畀和黃多啲時間好。

不過,我都同意朋友嘅睇法,我都希望3 UK可以好快公布上客數量,等市場都可以知道X-Series有幾勁。最後,呢幾日聽3 UK高層說話,察覺到佢哋sell 3嘅方法有變化,重點已經唔再放落功能身上,而係重複又重複咁講「無限無線寬頻服務」,撥亂反正,好事、好事。